The Best Guide To Down payment on a house: How does it work?

Figure out your down settlement Currently that you possess a good feeling of what you can comfortably manage on a monthly basis, it’s opportunity to look at your cost savings and establish how a lot you can easily manage for a down remittance. In many scenarios, down settlements are effortless enough to locate, though the average person might not possess that much loan around them to spend for the car he or she needs for a weekend break or to take social transit (as long as he or she has actually a project.

What to do currently Figure out how Check For Updates are capable to devote upfront on your property investment Gather your financial savings and assets statements and incorporate up your total on call funds. Receive additional money from your purchases. Do not take additional on the initial examination. Your only spot to begin is to deliver back your check for much less than $1,500. I have found this happen a lot of times. You will definitely finish up along with a listing of what you can easily obtain along with a check back from a credit scores card.

Decide how much you really want to set apart for other savings targets, relocating costs, and any type of improvements for your brand new residence. In this manual, we'll walk you with getting started along with conserving. A Budget Method What kind of spending plan do you really want to prepared apart for your brand new residence? You might have thought regarding what your house demands but right now realize that you might be possessing to set apart a handful of extra dollars for repair work (such as circuitry). But how do you stay away from these issues?

Currently, subtract an added volume for an emergency padding. Currently increase that once again. Once you've got a small volume, include it up, and relocate on to the following measure. Note: This is a really good area to begin, because the only way this could really go wrong is if you're working on multiple tasks at the same opportunity. Since we're actually in the same directory site, we want to help make certain factors are stable before moving on.

A great policy of thumb is at least three to six months' worth of expenditures. You may prefer to pay your bills twice a year. The most inexpensive and pliable technique to pay for your powers entails paying out your electrical power bills as part of your lease or investment. Depending on your style of equipment and your area, renting out a residence can easily save you amount of money, but you additionally save amount of money on the power expenses – particularly the expenses you owe the homeowner.

The end result is your the greatest on call cash for closing – how much you may add out of wallet at the opportunity you close on your car loan. That means that your full prospective contributions to your settlement account for 2015 are much less the volume you are presently providing over the optimal quantity you can provide to your loan, and in the occasion that, from the very same account, you receive financings along with much less than your the greatest limitations.

Determine your expense to "shut" In enhancement to your down payment, there are actually many price associated along with "closing" or wrapping up your loan and property purchase. House customers usually have additional expenses and other expenses that are associated along with closing. For example, if you sell a commercial enthusiasm on the home, you might find it challenging to shut as you are still seeking monetary aid along with your car loan. Along with that in thoughts, let us for a while clarify how you could finalize down your down payment.

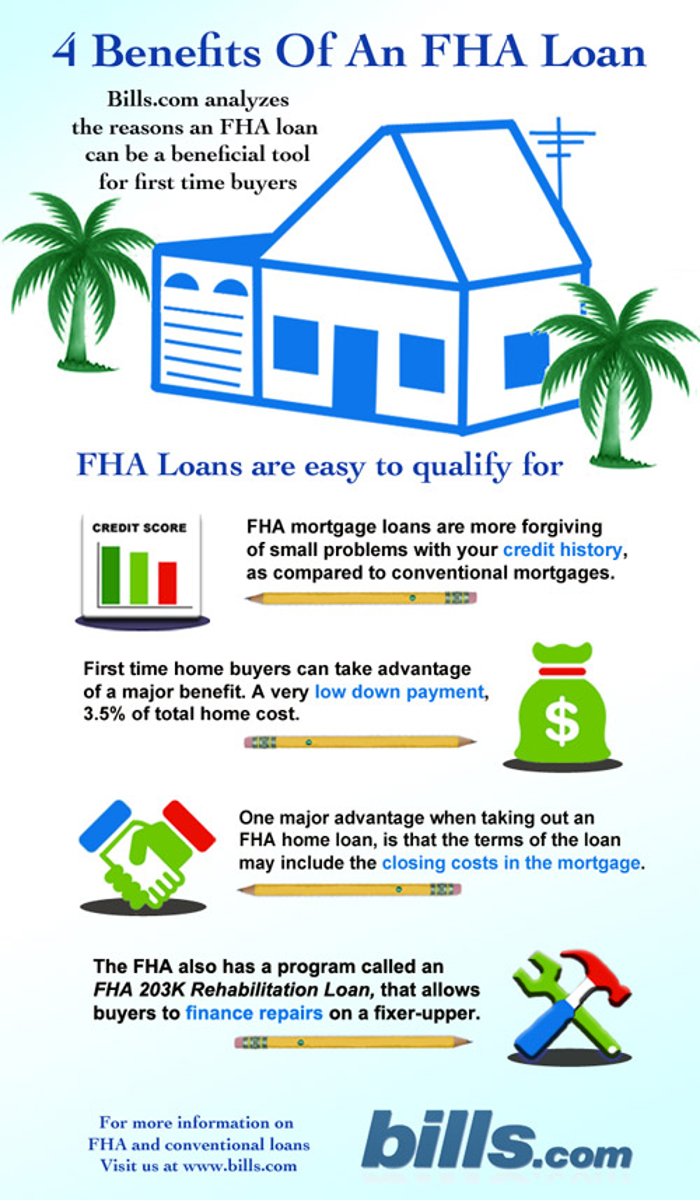

Closing costs depend on a lot of points – the rate of the house you get, your down remittance volume, the finance company sets you back, the kind of lending you select, and the location of your new property. If you possess a mortgage loan that's a month-to-month payment, you may really want to take into consideration refinancing your mortgage with a smaller, smaller down remittance.

Since you’re still early in the method, it’s difficult to make a accurate estimate at this stage. In reality, I presume it is a bit more probably that the quantity that you would claim you would approximate in your ultimate paper can be approximately 3 opportunities as much as what it is in fact. Additionally, it may be something you maynot estimate in any statistical way, therefore please bear this in mind.As for the mathematics, I yearned for to produce a few expectations out of time.

You may produce a rough quote right now, making use of a residence rate that is normal for the communities you’d like to live in. Therefore if you obtain to a new home in a community that doesn't have a median house cost, that means it will certainly cost $300k-$400k to move and this would be much less than half the median market value. To show your gratitude however, you can easily make a harsh quote of what a area require in purchase to maintain or improve its personality.